The cold winter is coming, and the Beixi pipeline has stopped supplying gas due to the leakage accident. The European continent, which is already in a state of energy crisis, is making it worse. The EU's sanctions against Russia should never be relaxed. For the purpose of winter storage, LNG ships specialized in transporting liquefied natural gas were snapped up, and the LNG market freight continued to rise! The constant change of LNG trade pattern has continuously increased the demand for LNG tons in the sea, stimulating the enthusiasm for building LNG ships; To solve the urgent problem, FSRU (Floating Storage and Re gathering Unit) has also become a straw for Europe.

- Definition and Classification of LNG Ship

Liquefied Natural Gas (LNG) ship refers to the ship specially carrying liquefied natural gas in bulk, or LNG ship for short. The earliest LNG ship was the 5100 square meter "Methane Pioneer", which was rebuilt from an ordinary old oil tanker in 1958 in the United States. According to the structural form of the cargo tank, LNG ships are mainly classified in the following two ways: self-supporting type and membrane type. The former is to place cylindrical, tank shaped and spherical tanks in the ship; the latter adopts a double shell structure, and the inner shell is the bearing shell of the liquid cargo tank. Compared with the self-supporting type, the membrane type has the advantages of high volume utilization rate and light structure weight. Therefore, new LNG ships, especially large ones, mostly adopt the membrane structure. According to the size of tank capacity, it can be classified into small (gas tank capacity<100,000 cubic meters), conventional (gas tank capacity is between 100,000 and 200,000 cubic meters, according to the actual construction, it can be divided into two representative ship types: 120,000 to 150,000 cubic meters and 150,000 to 180,000 cubic meters), Q-FLEX (gas tank capacity is about 210,000 cubic meters) and Q-MAX (gas tank capacity is about 260000 cubic meters), of which Q-FLEX and Q-MAX are two super large LNG carriers, LNG carrier type jointly developed by Qatar Energy and ExxonMobil.

Figure 1 Route Distribution of LNG Ship

- Existing fleet:

According to the statistics of hifleet archives, there are 704 LNG ships in the world, including floating gas storage ships and LNG bunkering ships.

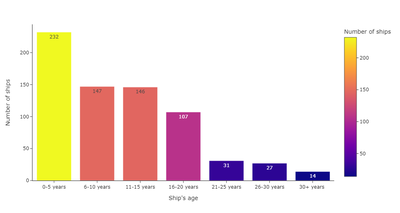

Ship age structure composition:

ship age statistics: the average ship age of the current LNG fleet is 11 years, as shown in Figure 2: LNG ship age distribution. In the existing LNG fleet, there are 232 ships with ship age less than 5 years, accounting for about 32.95% of the total number. Next are ships with ship age of 6-10 years and 11-15 years, respectively, 147 and 146. There are 14 LNG ships with ship age more than 30 years, more than half of which are idle and will be phased out by the market.

Figure 2 LNG Ship Age Distribution

Structure composition of fleet capacity:

As shown in Figure 3: Up to now, the tank capacity of LNG ships in the world is mainly distributed in the range of 120,000-180,000 cubic meters. There are 395 LNG ships with a tank capacity of 150,000-180,000 cubic meters, accounting for 56.10% of the total. There are 72 small LNG ships with a tank capacity of less than 100,000 cubic meters, including 33 Q-FLEX and 15 Q-MAX ships.

Figure 3 Storage Capacity Distribution of LNG Ship

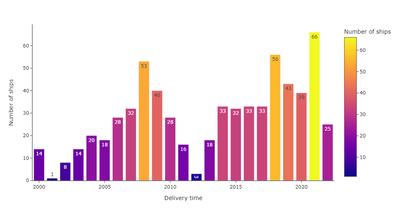

Delivery year distribution of existing fleet:

As shown in Figure 4: Year of delivery of LNG ships, 99 of the existing LNG ships were delivered in 2021, the highest in all years, followed by 56 in 2018 and 53 in 2008. Up to now, according to the latest data, 25 LNG ships will be delivered and put into operation in 2022.

Figure 4 LNG Ship Delivery Year

- New shipbuilding situation

As shown in Figure 5, the number of LNG new shipbuilding orders has reached new highs in recent years, with 85 new shipbuilding orders in 2021. With the promotion of Qatar's "100 ship plan", so far, the total number of new orders for LNG ships in 2022 has reached 135, an increase of more than 200% compared with 60 ships in the same period last year.

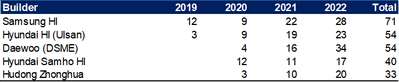

As shown in Table 1, the order quantity of LNG ships in each shipyard will increase significantly in 2022. Among them, the cumulative order quantity of South Korea's Daewoo Shipbuilding (DSME) is 34, ranking first temporarily. Samsung HI of South Korea followed closely with 28 orders, and Hyundai HI (23), Hudong Zhonghua (20) and Hyundai Samho HI (17) ranked 3-5 respectively. It is worth noting that more Chinese shipyards have joined the ranks of LNG carrier builders, and Jiangnan Shipyard (5 ships) and Dalian Shipyard (4 ships) have officially entered the LNG ship building market.

Figure 5 Order Quantity of LNG New Shipbuilding

Table 1 Order Quantity of LNG Ship in Each Shipyard

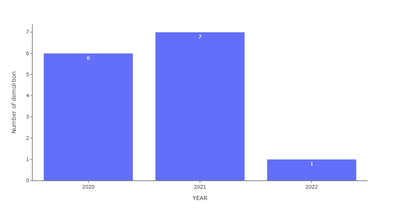

- Ship dismantling:

As shown in Figure 6, the number of LNG ships dismantled in recent three years has remained in single digits compared with other ships. A total of 14 LNG ships have been dismantled in the past three years. Among them, 6 LNG ships will be disassembled in 2020, 7 LNG ships will be disassembled in 2021, and only one LNG ship, "Dahlia", will be disassembled in India by 2022. The tank capacity of the LNG ships disassembled above is 120,000~130,000 cubic meters, with an average age of 38 years.

Figure 6 Disassembled quantity of LNG ships in recent three years

- Freight

The cold winter is coming, and the heating demand makes European buyers more and more worried about the natural gas supply. The demand for LNG carriers in Europe has increased significantly, and the global LNG ship freight rate has reached a new historical high. The latest data on October 14 showed that the spot freight rate of 174,000m3 LNG carrier had reached an amazing 485,000 dollars/day, an increase of 169.44% compared with last year's 180,000 dollars/day. Since September this year, the average growth rate of LNG spot freight of 160,000 m3, 145,000 m3 and 174,000 m3 has reached 32.5%, 41.4% and 25.76% respectively. It is unclear where the "ceiling" of LNG freight is.

Figure 7 LNG spot freight

- FSRU

FSRU refers to the Floating Storage and Re-gasification Unit , which is characterized by less initial investment, good economy, short construction period, flexible layout, etc. The Russia Ukraine war has plunged Europe into an energy crisis. In addition to causing the LNG carrier market to be in the "three high" state of "high gas price, high freight and high ship price", the demand for FSRU, a relatively small ship type, has continued to rise, which is known as one of the solutions for some European countries to deal with the LNG energy crisis.

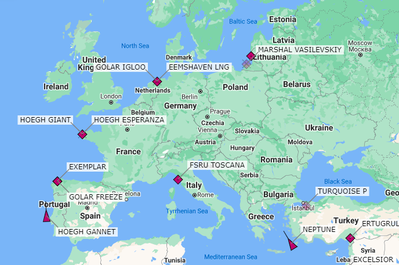

It is reported that Germany is installing a FSRU at the Port of William in the North Sea. It plans to deploy three FSRUs. The operation can be started as soon as the winter of 2022. Italy, Finland, the Netherlands and other European countries have deployed FSRU to receive the natural gas transported by sea.

Figure 8 Distribution of FSRU in Europe

Note: The above data are based on public information and Hifleet.